Get to know GL today!!!!

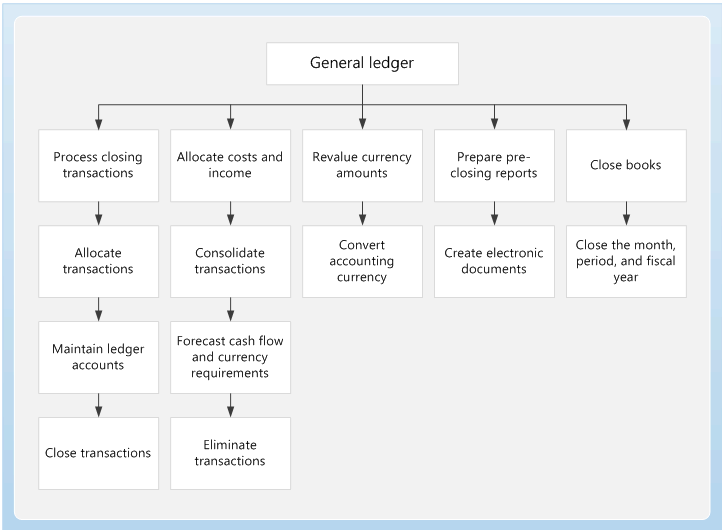

Use General ledger to define and manage the legal entity’s financial records. The general ledger is a register of debit and credit entries. These entries are classified using the accounts that are listed in a chart of accounts.

You can allocate, or distribute, monetary amounts to one or more accounts or account and dimension combinations based on allocation rules. There are two types of allocations: fixed and variable. You can also settle transactions between ledger accounts and revalue currency amounts. At the end of a fiscal year, you must generate closing transactions and prepare your accounts for the next fiscal year. You can use the consolidation functionality to combine the financial results for several subsidiary legal entities into results for a single, consolidated organization. The subsidiaries can be in the same database or in separate databases.